Tax certificates for donations : update

To allow donors to benefit from the tax reduction provided in Article 145/33 of the Income Tax Code (hereafter « ITC »), organisations must fulfil certain formalities, including issuing a tax certificate to donors.

In its new advice published on the February 3rd, 2025[1], the Belgian tax authorities state the following :

1. There is no mandatory model for the tax certificate;

2. The tax certificate must contain the following information:

- calendar year for which the certificate is issued;

- order number;

- full details of the organisation;

- full name, individual national number or registration number with the Crossroads Bank for Enterprises (hereafter “CBE”), and address of the donor;

- amount of the donation, specifying that it is final and irrevocable.

3. For donations received in 2024, there is a tax tolerance : the national number or CBE number does not need to be mentioned (even though Article 323/3 of the ICT came into force on January 1st, 2024).

4. In principle, the tax certificate must be submitted to the donor within two months following the end of the calendar year.

5. If two individuals make a donation together, only one name and one national number can be used; only the individual named on the certificate will benefit from the tax reduction.

If the two individuals are married or in legal cohabitation, the tax reduction will be allocated proportionally, based on their respective incomes.

6. The data included in the tax certificate must be transmitted annually to the tax authorities, before March 1st of the following year (Article 323/3, § 1 ICT), via Belcotax-on-web.

For donations made in 2024, this report must be submitted before March 1st, 2025.

7. If an organisation does not have the necessary IT resources to comply with the reporting obligation, it can obtain an exemption[2] by making a formal request before March 31, 2025 for donations received in 2024.

This exemption applies only for one year.

For donations made in 2025, this formal request will have to be submitted before the January 31, 2026.

***

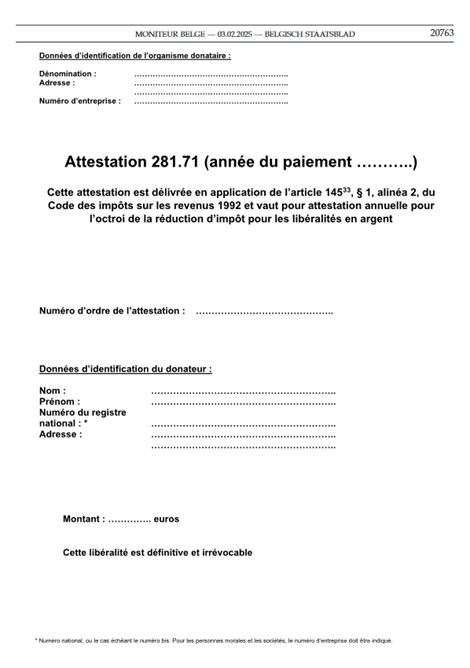

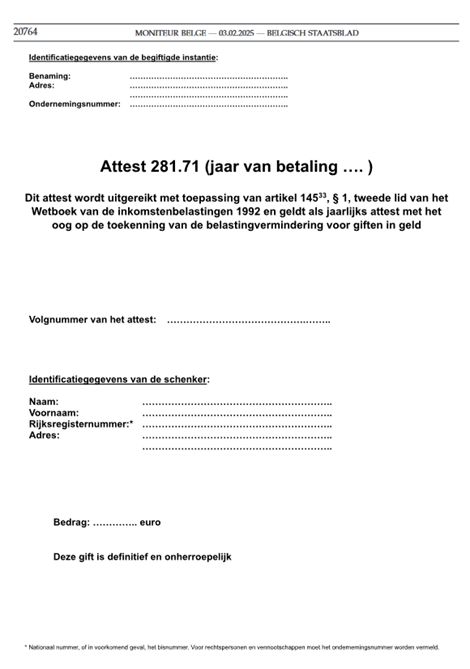

A new model of tax certificate has been published in the Belgian Official Gazette on February 3rd, 2025:

Olivier Willez & Charlotte Watteyne

[1] Tax Administration, Notice to organisations authorised to issue certificates for donations eligible for a tax reduction for donors, Belgian Official Gazette, February 3, 2025, n° 2025000896.

[2] Article 323/3, § 2 of the ICT.